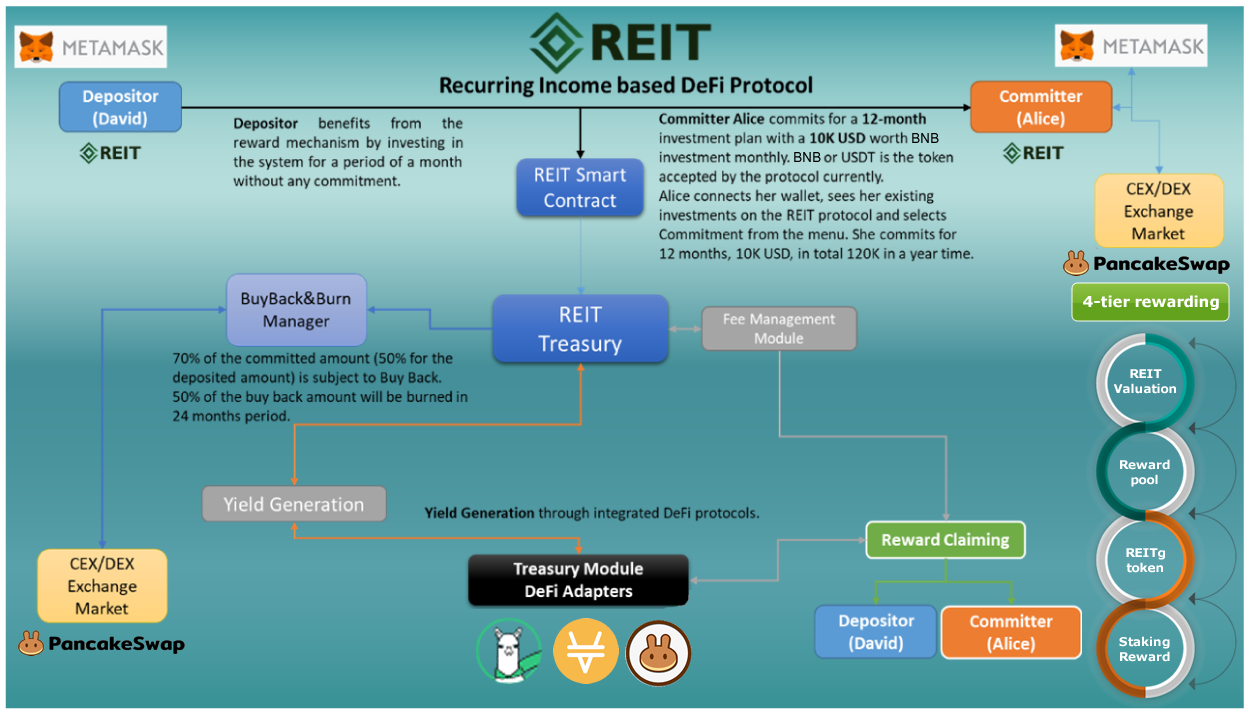

Committers create commitment plans between 3 to 12 months that automatically ensure reduction of REIT token supply in circulation (through strategic/structural Buy Back & Burns) which will assure the valuation of the token and provide additional yield generation for investors/token holders. 70% of all commitments automatically transfer into Buy Back & Burn. Additionally, 50% of all buy backs are burned automatically in a 24 months buy back and burn plan. Committers can mine REIT and REITg tokens only through investment.

Depositors do not need to provide any commitment (spread over months) but they are still allowed by the system to generate yield, receive REITg and get benefit from the total collected rewards. Depositors invest for a period of a month and they are allowed to mine REITg tokens through investment but depositors receive far less REITg tokens than Committers (1/4th of the minted REITg tokens monthly).

An investor is a Depositor if s/he does not want to give any monthly commitment plan but would still like to benefit from the yield generation capacity of the protocol and receive REITg tokens.

Depositor can connect their wallets into the system, deposit BNB or USDT, and receive REIT and REITg in return. Depositors can benefit from the reward mechanism without making any commitments but the rewards allocated to depositors will be 1/4th of the Committers reward allocation.

HoDLers - token holders – exchange REIT tokens and expect to get benefit from the valuation of the token. They buy and sell REIT and REITg tokens on the exchange markets.

Trading REIT is easy. REIT will be available on various major centralized and decentralized market exchanges (CEX & DEX) and will be expanding its availability on several markets. A HoDLer will be able to purchase the REIT token from existing trading platforms or supported DeFi exchange protocols such as PancakeSwap , Sushiswap , etc.

REIT Finance DeFi is a recurring income yield generation protocol that aims not only to assure and sustain the valuation of the REIT token but also to allow users to provide commitment plans on the protocol to start buy back and burn process and also generate yield using the treasury of the protocol.

Protocol provides the following functionalities to different end-users (Figure 1).

Treasury is the main pool of the protocol. All collected funds are stored in the treasury pool and this pool is used for investing on other DeFi protocols for yield generation with multiple strategies. Treasury consists of BNB pool and USDT pool (currently supported crypto currencies) coming from Committers and Depositors.

Treasury ensures the usage of the best of breed DeFi protocols through integration with popular and well proven DeFi protocols including Alpaca, Venus.io and PancakeSwap. The amount collected in the Treasury will be invested in these protocols under the most favorable conditions, and the obtained interest income will be shared among all protocol stakeholders.

Treasury rules and policies:

• To invest into well-known and proven DeFi protocols for yield generation for Committers and Depositors.

• To buy back & burn REIT tokens from the exchange markets and reduce the total supply.

• Current deposit assets for REIT protocol are BNB and USDT. In the upcoming period, REIT governance committee will decide for additional deposit assets.

• Treasury will deploy deposited assets into third-party DeFi products that generate interest for Committers and Depositors. Treasury funds will be used to borrow, lend, and farm yield across various DeFi projects.

• Investment strategy will be defined by the protocol committee.

REIT DeFi protocol will apply a buy-back & burn strategy to assure the higher valuation of the token by reducing the total supply periodically and systemically in order to protect and reward its investors.

• Buy back rate for Committers: 70% of the investment amount.

• Burn rate for Depositors: 50% of buy back amount.

For each installment that the Committers commit and the Depositors deposit, the protocol guarantees to start a buy-back and burn operation for the 70% and 50% of each transaction amount, respectively. 50% of the buy-back amounts will be burned automatically by the protocol in 24 months’ period. The buy-back & burn operation will be completed for each installment by the protocol each month in equal amounts for a period of 24 months in order to protect the investors and to avoid rapid price increases and arbitrage risks. All buy-back transactions will be published and will be transparently traceable on the DeFi REIT front-end app and blockchain network via Etherscan .

There are two types of fees applied on the platform. One is for the transaction and the other is for the management of the Treasury.

Transaction Fee: There will be a transaction fee (0,40%) for both Committers and Depositors. This fee will be applied for each commit and deposit transaction and will be accumulated in the Treasury fee pool. 5⁄8 of the total collected fees will be incentivized and distributed to stakeholders of the protocol according to the rewarding policy. Protocol fee will remain as 0,15% in the protocol after fee distribution to investors.

Management Fee: REIT protocol will apply a quarterly management fee (0,25% of the total value locked in the protocol) for the management of the protocol. This management fee will be released to the management team on a quarterly basis.